Still worrying about how to write a cheque or convert number to words for your cheques automatically? Get personal or business free check writing software / free cheque printing software here:

Advertisement

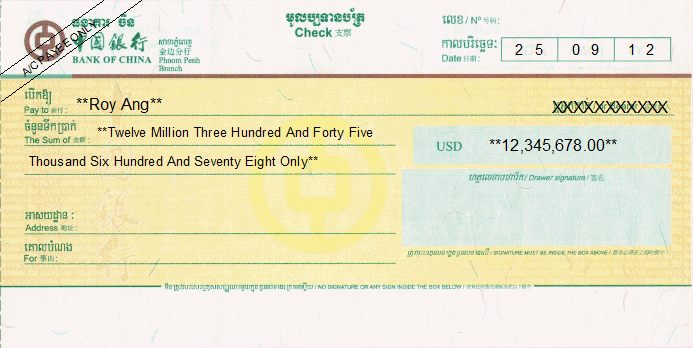

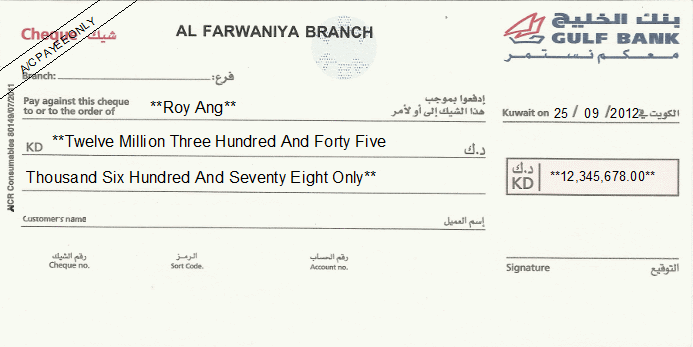

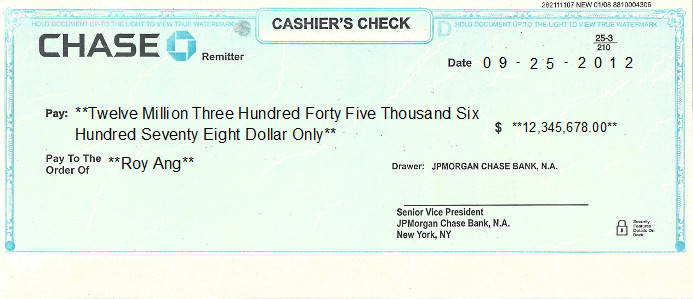

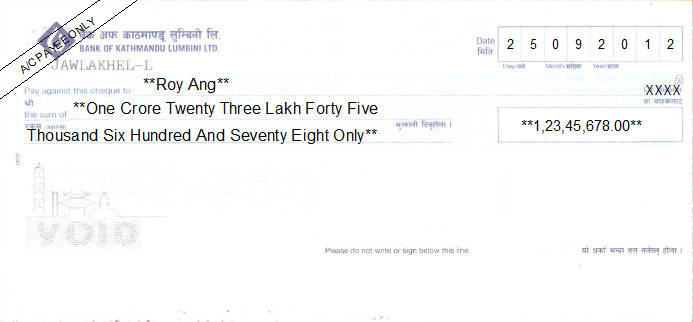

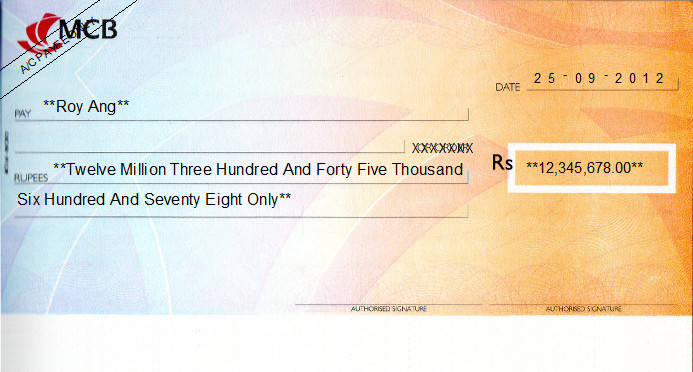

Professional Cheque Printing Examples:

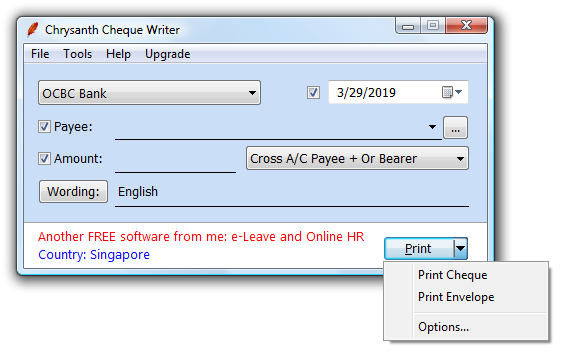

Simple and easy to use screenshot for Chrysanth Cheque Writer software:

Why You Need To Use Check Writing Software?

- To save time and cheques by avoiding typo or unclear writing when writing a cheque manually, such as writing the word FORTY as FOURTY

- Your payees will have a better impression of your business when they receive a well printed check

- When making payments via cheque on a recurring basis, you may store and print the payees' mailing address easily

- It's FREE compared to a costly check writer machine!

- It's extremely easy to set up, all you need is a computer and a printer

- Literally NO learning curve at all

Cheque Printing

- You may use Laser Printer, InkJet Printer or Dot Matrix Printer to print cheques, however, please note that Chrysanth Cheque Writer only supports printers that support "Custom Page Size".

- Place your check in Portrait mode in the printer tray. For first time users, it is advisable that you cut a piece of blank paper into the size of your cheque and test print once, just to be sure how your printer's orientation is.

- Check Printing Features:

- Automatically prints cheque amount as words

- Prints up to 9 digits of cheque amount

- Prints mailing address on different sizes of envelope, including unlimited custom size envelope

- Writes post dated cheques at any future date

- Optionally prints cheques without date

- Cross your cheque with nicely printed "A/C Payee Only"

- Strike off "Or Bearer" with simple option

- Complies with local convention, such as Indian Crore and Lakh replacing Million and Billion in English

- Stores unlimited payees

- Printer Adjustment option for users to tune the alignment to work with their printers when necessary

- Completely FREE - While other cheque writing software and cheque writer machine may easily cost a lot of money, Chrysanth Cheque Writer is a completely FREE cheque printer for banks in Malaysia, Singapore, India, Hong Kong, Sri Lanka, Pakistan, Maldives, UAE, Oman, Cambodia, Kuwait, Qatar, The Philippines, Cyprus, Indonesia, Bahrain, Saudi Arabia, Lebanon, Macau, Tanzania, Bangladesh, Canada, Kenya, Guyana, Egypt, Brunei, United States of America, Germany, France, Papua New Guinea, Fiji, Malawi, United Kingdom, Nepal, Mauritius, Panama, Ethiopia, Uganda, Thailand, Somalia, Malta, Myanmar, Nigeria and with more countries support to come soon

- You can send me a BLANK scanned cheque and I will customize a version for your bank in your country in no time, ABSOLUTELY FREE!!!

- More features will be added later, if you have any feedback on the free check writer software, feel free to drop me a mail at This email address is being protected from spambots. You need JavaScript enabled to view it.

Supported banks and countries for the personal and business free cheque writing software / free cheque printing software:

![]() Malaysia Banks free cheque printing software

Malaysia Banks free cheque printing software

![]() Singapore Banks free cheque printing software

Singapore Banks free cheque printing software

![]() India Banks free cheque printing software

India Banks free cheque printing software

![]() Hong Kong Banks free cheque printing software

Hong Kong Banks free cheque printing software

![]() Sri Lanka Banks free cheque printing software

Sri Lanka Banks free cheque printing software

![]() Pakistan Banks free cheque printing software

Pakistan Banks free cheque printing software

![]() Maldives Banks free cheque printing software

Maldives Banks free cheque printing software

![]() United Arab Emirates (UAE) Banks free cheque printing software

United Arab Emirates (UAE) Banks free cheque printing software

![]() Oman Banks free cheque printing software

Oman Banks free cheque printing software

![]() Cambodia Banks free cheque printing software

Cambodia Banks free cheque printing software

![]() Kuwait Banks free cheque printing software

Kuwait Banks free cheque printing software

![]() Qatar Banks free cheque printing software

Qatar Banks free cheque printing software

![]() The Philippines Banks free cheque printing software

The Philippines Banks free cheque printing software

![]() Cyprus Banks free cheque printing software

Cyprus Banks free cheque printing software

![]() Indonesia Banks free cheque printing software

Indonesia Banks free cheque printing software

![]() Bahrain Banks free cheque printing software

Bahrain Banks free cheque printing software

![]() Saudi Arabia Banks free cheque printing software

Saudi Arabia Banks free cheque printing software

![]() Lebanon Banks free cheque printing software

Lebanon Banks free cheque printing software

![]() Macau Banks free cheque printing software

Macau Banks free cheque printing software

![]() Tanzania Banks free cheque printing software

Tanzania Banks free cheque printing software

![]() Bangladesh Banks free cheque printing software

Bangladesh Banks free cheque printing software

![]() Canada Banks free cheque printing software

Canada Banks free cheque printing software

![]() Kenya Banks free cheque printing software

Kenya Banks free cheque printing software

![]() Guyana Banks free cheque printing software

Guyana Banks free cheque printing software

![]() Egypt Banks free cheque printing software

Egypt Banks free cheque printing software

![]() Brunei Banks free cheque printing software

Brunei Banks free cheque printing software

![]() United States of America Banks free check printing software

United States of America Banks free check printing software

![]() Germany Banks free cheque printing software

Germany Banks free cheque printing software

![]() France Banks free cheque printing software

France Banks free cheque printing software

![]() Papua New Guinea Banks free cheque printing software

Papua New Guinea Banks free cheque printing software

![]() Fiji Banks free cheque printing software

Fiji Banks free cheque printing software

![]() Malawi Banks free cheque printing software

Malawi Banks free cheque printing software

![]() UK Banks free cheque writing software

UK Banks free cheque writing software

![]() Nepal Banks free cheque writing software

Nepal Banks free cheque writing software

![]() Mauritius Banks free cheque writing software

Mauritius Banks free cheque writing software

![]() Panama Banks free cheque writing software

Panama Banks free cheque writing software

![]() Ethiopia Banks free cheque writing software

Ethiopia Banks free cheque writing software

![]() Uganda Banks free cheque writing software

Uganda Banks free cheque writing software

![]() Thailand Banks free cheque writing software

Thailand Banks free cheque writing software

![]() Somalia Banks free cheque writing software

Somalia Banks free cheque writing software

![]() Malta Banks free cheque writing software

Malta Banks free cheque writing software

![]() Myanmar Banks free cheque writing software

Myanmar Banks free cheque writing software

![]() Nigeria Banks free cheque writing software

Nigeria Banks free cheque writing software

![]()

![]()

![]() and your country coming soon, when you send me the blank cheques to start with... ^_^

and your country coming soon, when you send me the blank cheques to start with... ^_^